Dealing with a broken appliance and wondering if your Vancouver home insurance will actually cover the damage? You’re not alone – many homeowners discover too late that improper documentation or missed filing deadlines can turn a covered claim into an expensive out-of-pocket repair bill.

Picture this: your three-year-old dishwasher suddenly floods your kitchen during Vancouver’s notorious winter storms, causing water damage to your hardwood floors and cabinets. You think you’re covered, but six months later you’re still fighting with your insurance company over depreciation calculations and coverage limits. Unfortunately, this scenario plays out in Vancouver homes more often than you’d think, especially with our city’s unique coastal climate creating appliance challenges that standard insurance policies don’t always address clearly.

The reality is that successful appliance insurance claims require much more than just calling your agent and hoping for the best. From understanding the difference between personal property and dwelling coverage to documenting Vancouver’s specific climate-related damage patterns, homeowners need a strategic approach to maximize their coverage. What makes Vancouver particularly tricky is our mix of older heritage homes, modern strata regulations, and coastal conditions that create unique damage scenarios insurance adjusters don’t see in other markets.

Whether you’re dealing with a salt air corrosion on your appliances, electrical surge damage from BC Hydro fluctuations, or water damage from Vancouver’s aging infrastructure, understanding the claims process can mean the difference between full replacement coverage and a disappointing settlement that leaves you thousands of dollars short. The key is knowing what documentation to gather, when to file, and how to work effectively with adjusters who may not understand Vancouver’s specific housing and climate challenges.

Key Outtakes

- Proper documentation within 24 hours of appliance damage significantly increases claim approval rates and settlement amounts

- Vancouver’s coastal climate creates unique appliance damage patterns requiring specialized documentation for salt air corrosion and humidity effects

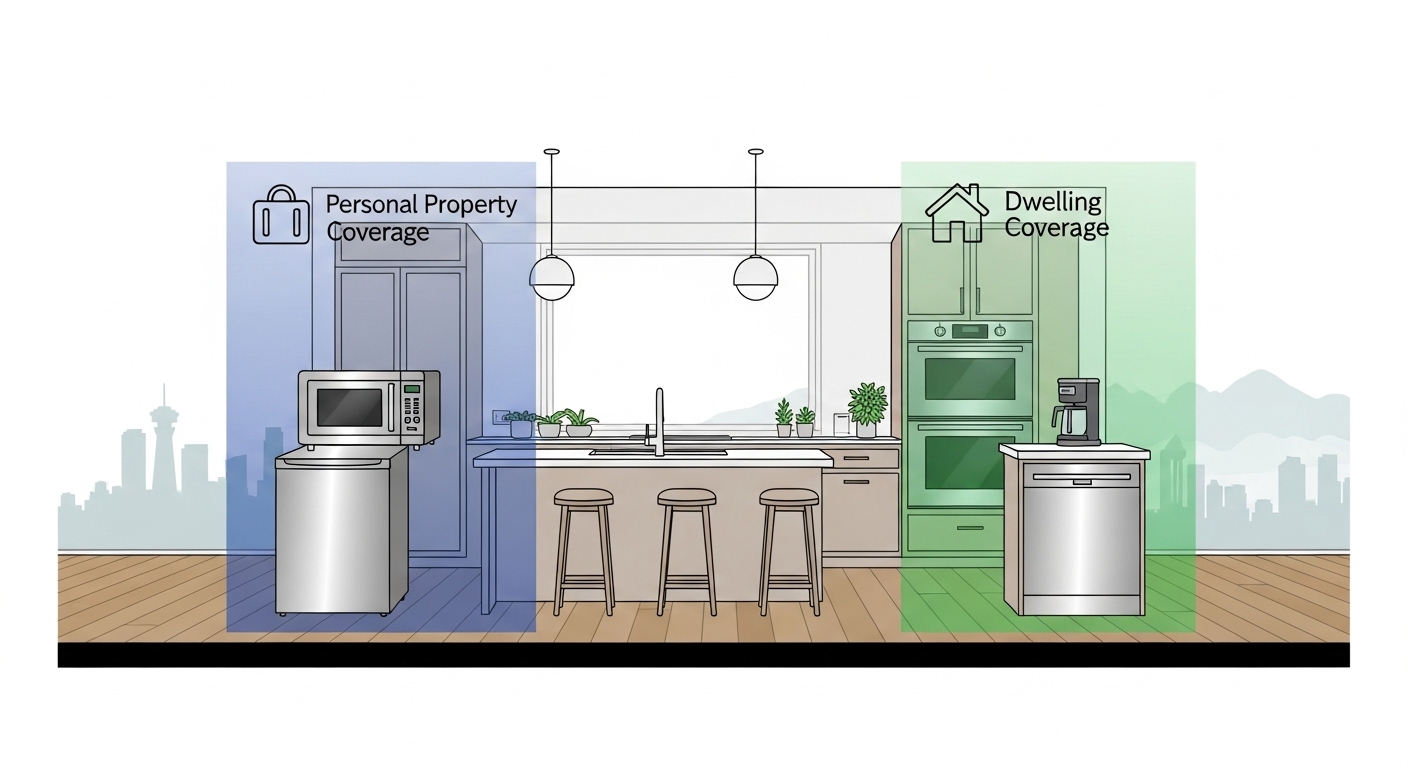

- Home insurance covers appliances through personal property coverage (portable items) or dwelling coverage (built-in systems), with different limits and deductibles

- Strata and condominium appliance claims require additional documentation and coordination that’s unique to Vancouver’s high-density housing market

- Understanding depreciation calculations and replacement cost coverage can help homeowners negotiate settlements that reflect Vancouver’s premium appliance market pricing

Understanding Vancouver Home Insurance Coverage for Appliances

Before you can successfully file an appliance insurance claim in Vancouver, you need to understand exactly what your home insurance policy covers and how appliances are classified. This isn’t as straightforward as most homeowners assume, especially in Vancouver where our unique housing mix of heritage homes, modern condos, and strata regulations creates coverage complications that don’t exist in other markets. The insurance industry hasn’t exactly kept pace with Vancouver’s rapid housing evolution, leaving homeowners in a frustrating gray area when appliances fail.

Most Vancouver home insurance policies classify appliances into two distinct categories that determine your coverage limits and deductibles. Personal property coverage typically applies to portable appliances like refrigerators, washing machines, dryers, and standalone freezers. These items are usually covered for 50-70% of your dwelling coverage amount, which means if you have a $500,000 home, your personal property coverage might cap out at $250,000-$350,000 total. However, this coverage is shared among all your belongings, so appliances compete with furniture, electronics, and clothing for the same coverage pool.

Dwelling coverage, on the other hand, applies to built-in appliances that are considered part of your home’s structure. This includes systems like HVAC units, water heaters, built-in dishwashers, and range hoods that are permanently installed. The good news is that dwelling coverage typically offers higher limits and sometimes lower deductibles than personal property coverage. The challenging part is that insurance companies don’t always agree on which appliances fall into which category, especially in Vancouver’s older homes where appliances might be semi-built-in or modified to fit unique spaces.

Vancouver homeowners also need to understand covered perils – the specific types of damage that trigger insurance coverage. The most common covered perils for appliance damage include electrical surges from power fluctuations during our frequent storms, fire damage that affects appliances beyond repair, sudden and accidental water damage from burst pipes or appliance malfunctions, and theft of portable appliances during break-ins. What’s crucial to understand is that normal wear and tear, gradual leaks, or maintenance issues are specifically excluded from coverage, regardless of how expensive the resulting damage might be.

One coverage option that’s becoming increasingly important for Vancouver homeowners is Home Systems and Appliance Breakdown (HSAB) coverage. This optional coverage provides up to $50,000 in protection with a $500 deductible per occurrence, specifically designed to cover mechanical, electrical, or pressurized system breakdowns that wouldn’t otherwise be covered under standard home insurance. For Vancouver’s strata buildings, HSAB coverage is often essential because shared utility systems can create individual unit liability that standard policies don’t address adequately. Equipment breakdown coverage typically costs from $25 to $50 per year, making it one of the most cost-effective ways to protect against expensive appliance failures.

Vancouver’s Coastal Climate and Its Impact on Appliance Insurance Claims

Living on Vancouver’s beautiful coast comes with environmental challenges that create absolutely unique appliance damage patterns, and understanding these patterns is crucial for protecting yourself from claim denials. Our marine climate doesn’t just affect how we dress or plan outdoor activities – it directly impacts how long our appliances last, how they fail, and most importantly, how insurance adjusters evaluate damage claims. The salty air that makes our sunsets so spectacular also accelerates corrosion in ways that insurance companies from Alberta or Ontario simply don’t encounter in their typical claims processing.

Salt air infiltration represents one of the most misunderstood aspects of Vancouver appliance damage, particularly affecting exterior units like heat pumps, air conditioning systems, and any appliances with exterior venting. This isn’t the kind of damage that shows up immediately – it develops gradually over months or years, creating corrosion patterns that might look like normal wear and tear to adjusters unfamiliar with coastal conditions. When documenting this type of damage, you need to photograph not just the obvious rust or corrosion, but also any unusual buildup of salt residue, deterioration of electrical connections, and performance issues that directly correlate with your appliance’s exposure to coastal air.

Vancouver’s notorious humidity creates ongoing challenges for appliances designed to manage moisture, and these challenges often fall into insurance company blind spots. Front-loading washing machines, while incredibly popular and energy-efficient, become particularly susceptible to mold and mildew issues in our persistently damp climate. These problems lead to frequent door seal replacements, persistent odor issues, and sometimes complete drum replacement – repairs that can easily cost $800-1,500 but often get classified as “maintenance issues” rather than covered mechanical failures. The key to successful claims lies in documenting how Vancouver’s specific humidity levels exceed manufacturer specifications and contribute to premature component failure.

Our frequent power fluctuations and outages put additional stress on appliance electronics that most other Canadian cities simply don’t experience to the same degree. Vancouver’s mix of aging electrical infrastructure in established neighborhoods and rapid development putting strain on the grid creates power quality issues that wreak havoc on sensitive electronic components. Control board failures, digital display problems, and electronic component burnouts occur much more frequently here than in areas with stable, modern power grids. These failures often fall outside standard warranty coverage if insurance companies decide they’re related to power quality rather than manufacturing defects, making proper documentation of power conditions absolutely essential.

The interaction between Vancouver’s coastal humidity and electrical systems creates particularly challenging documentation scenarios for insurance claims. Moisture infiltration into electrical components doesn’t always cause immediate, obvious failure – instead, it creates gradual deterioration that might manifest as intermittent operation, unusual error codes, or performance degradation that gets worse over time. Insurance adjusters trained in drier climates might not recognize these patterns as environmental damage, instead classifying them as normal aging or inadequate maintenance. Successful claims require detailed documentation of environmental conditions, maintenance records showing compliance with manufacturer recommendations, and expert assessments that clearly link the failure to Vancouver’s specific climatic conditions. Understanding BC Hydro’s limited claims coverage helps homeowners realize they’ll need to rely on their home insurance for most power-related appliance damage.

Step-by-Step Documentation Process for Maximum Claim Approval

The success of your appliance insurance claim often depends entirely on the quality and completeness of your initial documentation, a reality that becomes even more critical in Vancouver where our coastal climate and diverse housing stock create damage patterns